资本资产定价模型CAPMppt课件.ppt

天马****23

亲,该文档总共45页,到这已经超出免费预览范围,如果喜欢就直接下载吧~

相关资料

资本资产定价模型CAPMppt课件.ppt

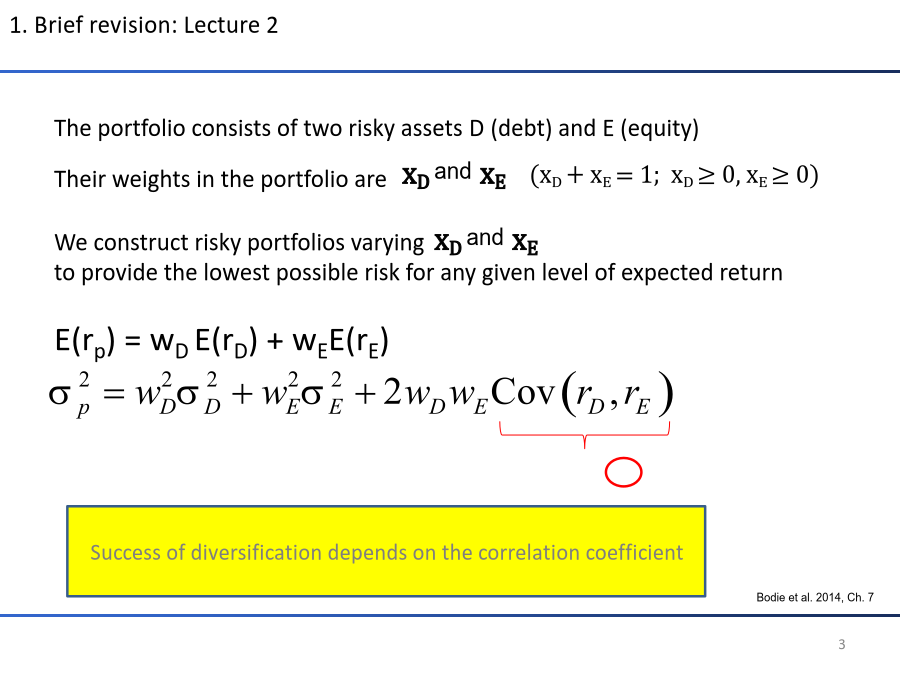

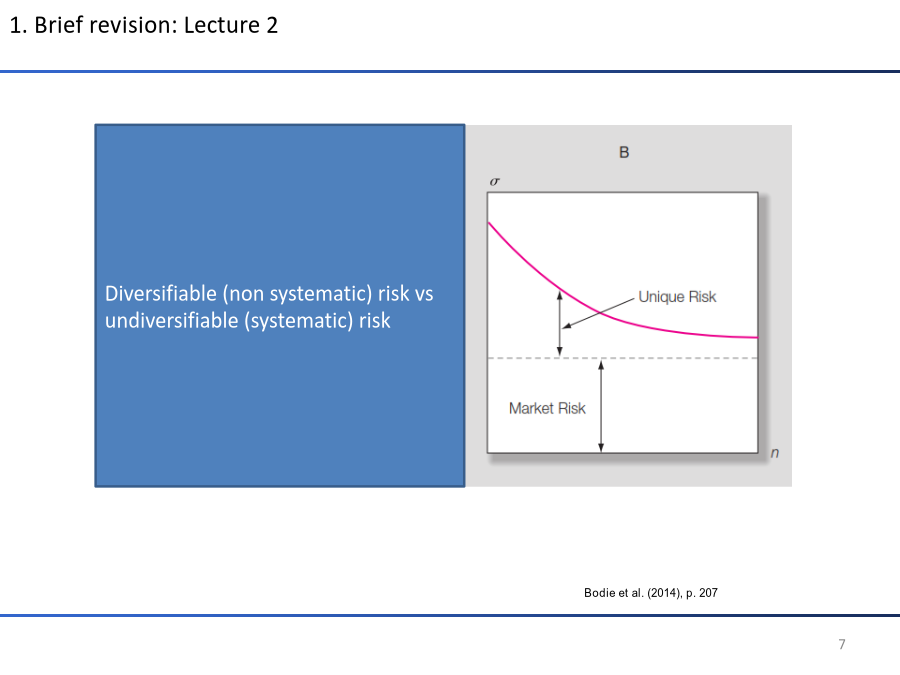

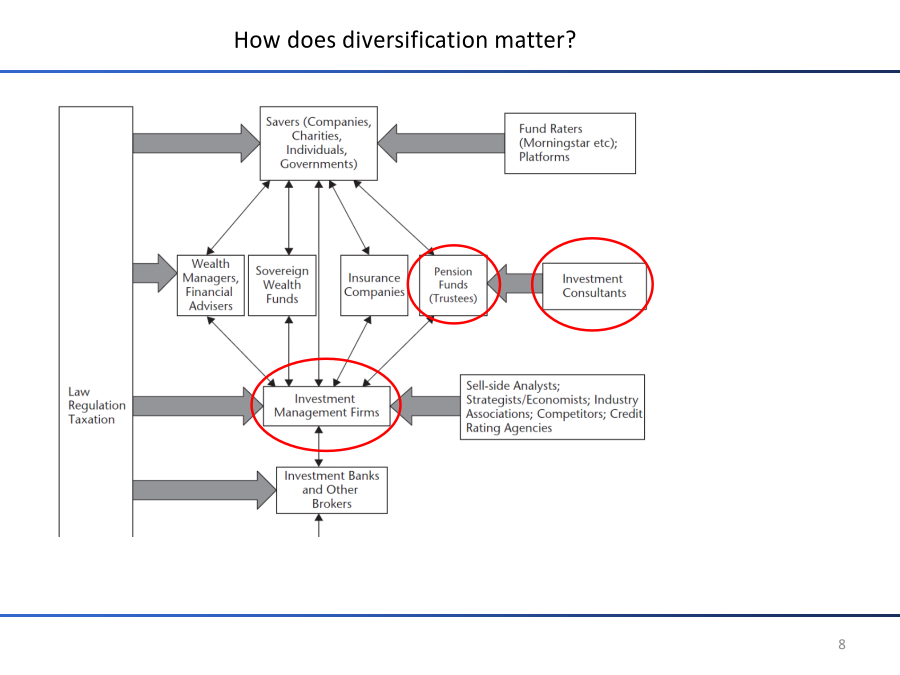

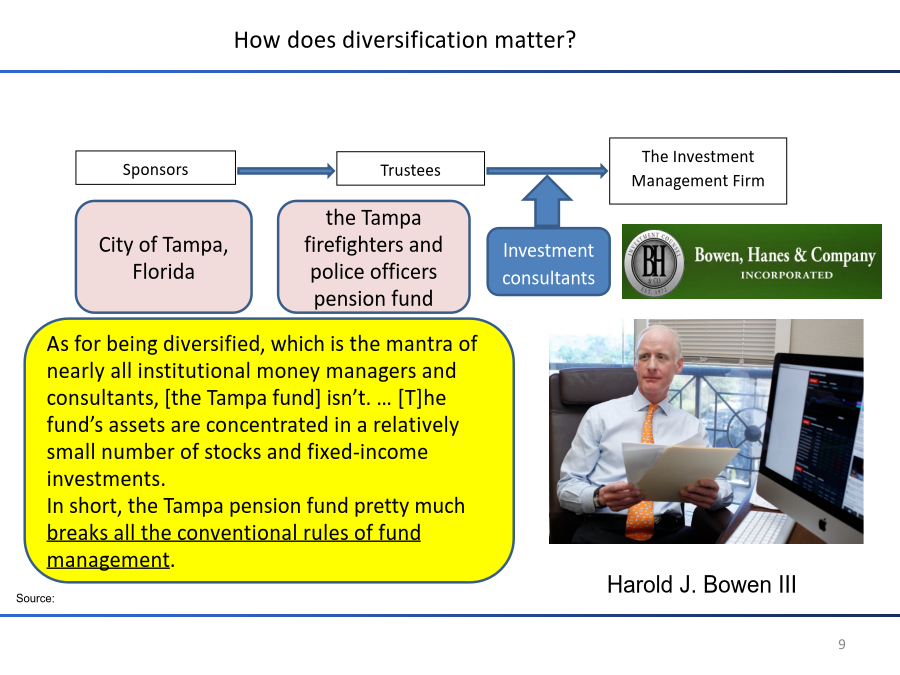

FoundationsofFinancialAnalysisandInvestmentsToday‘slectureTheportfolioconsistsoftworiskyassetsD(debt)andE(equity)TheirweightsintheportfolioareWeconstructriskyportfoliosvaryingtoprovidethelowestpossibleriskforanygivenlevelofexpectedreturnE(rp)=wDE(rD)+wEE(

资本资产定价模型CAPM模型ppt课件.ppt

资本资产定价模型CapitalAssetPricingModel第一节CAPM模型介绍资产的价值分析来源于微观经济学的观点:任何一种资产的现在值是未来收入的流量在今天的价值,即未来收益的贴现。这种根据资产未来收入流量确定资产现在价值的研究被称为资产定价。在上述研究中需要解决两个基本难题:1、众多的投资者偏好、大量不同质的资产和多时期性使得未来收入流量一般是未知的和不确定的,因此,如何描述这样复杂的随机过程是资产定价的第一个难题。2、众多的投资者之间的联系,大量不同质资产之间的联系,多时期之间的联系是资产定

风险资产的定价——资本资产定价模型.ppt

风险资产的定价-资本资产定价模型本章主要问题本章重点内容第一节无风险借贷及其对投资组合有效集的影响第二节标准的资本资产定价模型--资本市场均衡及均衡时证券风险与收益的关系第三节特征线模型--证券收益率与均衡时市场收益率的关系、阿尔发系数第四节资本资产定价模型的检验与扩展第一节无风险借贷对有马科维兹有效集的影响一、无风险资产的定义根据定义无风险资产具有确定的回报率,因此:首先,无风险资产必定是某种具有固定收益,并且没有任何违约的可能的证券。其次,无风险资产应当没有市场风险。二、允许无风险贷款下的投资组合考虑

风险资产的定价-资本资产定价模型.ppt

风险资产的定价-资本资产定价模型本章主要问题本章重点内容第一节无风险借贷及其对投资组合有效集的影响第二节标准的资本资产定价模型--资本市场均衡及均衡时证券风险与收益的关系第三节特征线模型--证券收益率与均衡时市场收益率的关系、阿尔发系数第四节资本资产定价模型的检验与扩展第一节无风险借贷对有马科维兹有效集的影响一、无风险资产的定义根据定义无风险资产具有确定的回报率,因此:首先,无风险资产必定是某种具有固定收益,并且没有任何违约的可能的证券。其次,无风险资产应当没有市场风险。二、允许无风险贷款下的投资组合考虑

风险资产的定价——资本资产定价模型.pptx

风险资产的定价-资本资产定价模型本章主要问题本章重点内容第一节无风险借贷及其对投资组合有效集的影响第二节标准的资本资产定价模型--资本市场均衡及均衡时证券风险与收益的关系第三节特征线模型--证券收益率与均衡时市场收益率的关系、阿尔发系数第四节资本资产定价模型的检验与扩展第一节无风险借贷对有马科维兹有效集的影响一、无风险资产的定义根据定义无风险资产具有确定的回报率,因此:首先,无风险资产必定是某种具有固定收益,并且没有任何违约的可能的证券。其次,无风险资产应当没有市场风险。二、允许无风险贷款下的投资组合考虑